Companies

Products

Athena, your OMS/PMS platform

The right data and tools for your trading and investment needs

One connection to global, multi-asset analytics, news and insights

Flexible solutions, comprehensive market data and services

Innovative, efficient, buy-side workflow automation solutions

All the data required for reporting and enhanced compliance

Digital solutions for a premium client experience

Enterprise-wide digitalization through a single platform

One platform, end-to-end digital transformation

Keep pace with technology, exceed customer expectations

Monitor, measure and maximize value

Quality, multi-asset data and analytics from a single vendor

'One stop' smart access to global trading and market data

Take a look at the "Definitive guide to Evaluated Real-Time Prices" to discover how you can save costs today.

ATHENA - Part of United Fintech

Athena was developed by industry-leading figures with extensive experience supporting both buy-side and sell-side organizations. The ethos of Athena is to provide one true platform to streamline a firm's investment processes from start to finish.

Athena provides financial services firms with an all-in-one SaaS solution to match their business strategy's unique refinements, helping them elevate their baseline operations up to true competitive advantage by covering their whole investment process under a single license.

Full-featured OMS/PMS that meets the specific requirements of a Multi-Strategy, Multi-Prime Hedge Funds with superior coverage for alternative asset workflows.

A unified platform that integrates Model Management, Rebalancing, Order Management, E-Trading, Compliance, Fund and Investor Accounting and Client Communication.

Real-time information and alerting platform for large, multi-entity firms like brokers, banks, and managers to monitor exposures, P&L, risk, margin, analytics, netting, etc.

Launching a fund is complex. In most cases, new firms are price-sensitive and demand high speed. Athena Spark has been specifically tailored to match the conditions of new launches.

A full-featured Order and Portfolio Management System that meets the specific requirements of a Family Office and includes superior coverage for alternative asset workflows.

Create a simple order in just two clicks. Electronically submitting trades to brokers for execution as DMA, high-touch, or Algos, among many other capabilities.

Effectively manage the risk and compliance of your portfolio through a various number of risk calculators, reporting, and alerts.

Accountants and trade managers benefit from modules such as Reconciliation, Fund and Investor Accounting, Straight-Through Processing, SFTP connections, etc.

Developers and database administrators can count on our IT team's extensive experience. Our content can be accessed from our platform, web reports, Excel Add-In, APIs, and SQL.

Athena is the only system on the market to provide real-time portfolio and trade monitoring, including holdings, trade status, P&L, risk and stress tests, Flash-NAV, and cash monitoring. All of it covered with zero downtime while providing transparency into control over various compliance requirements.

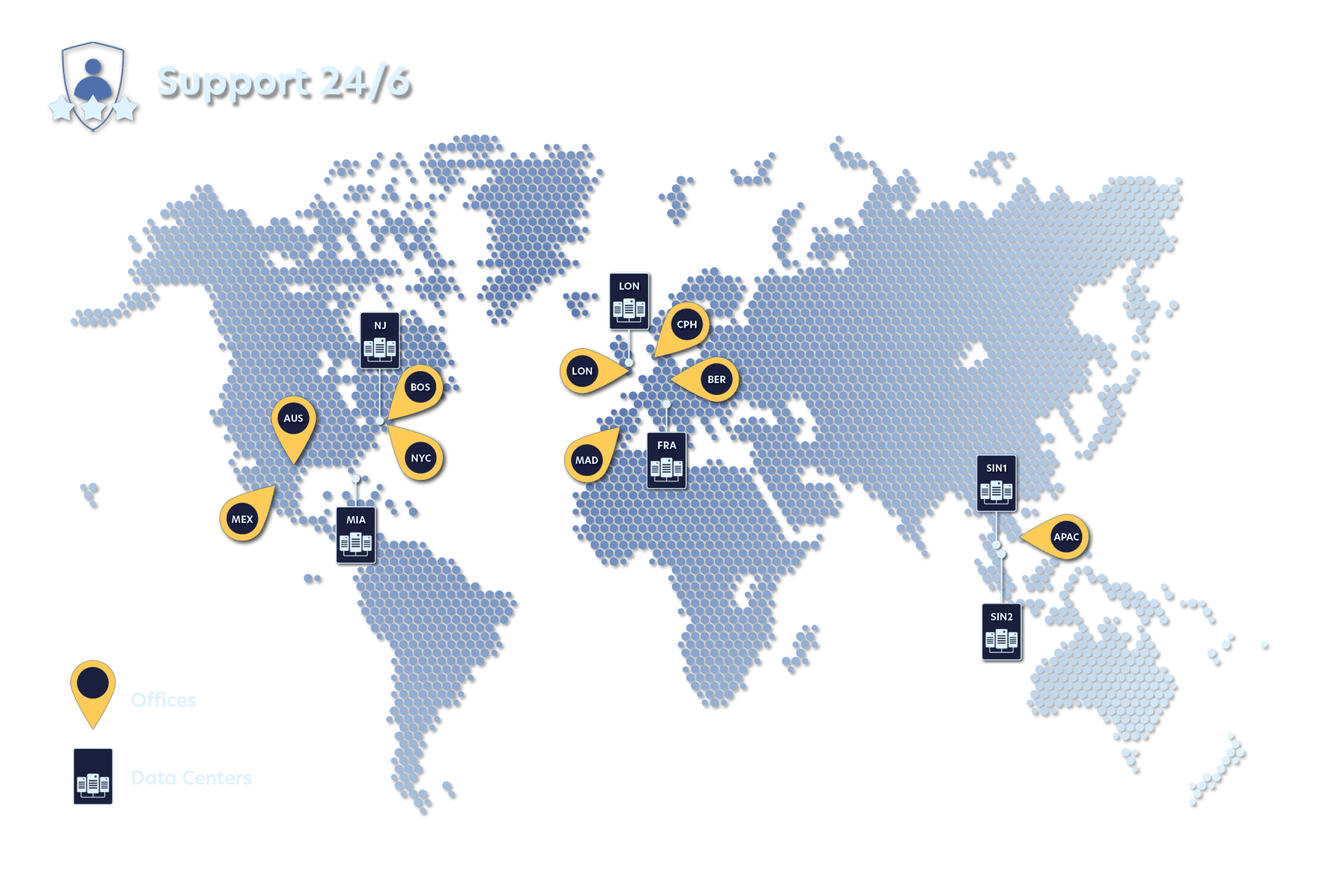

Contact Athena's Support at support@athenasystems.com or call the phone number of your region:

Americas Support

+1 978 456 4009

1411 Broadway, 16th Floor

New York, NY 10018

United States of America

EMEA Support

+34 919 54 93 94

Alcalá 4, 5ºD

Madrid, 28014

Spain

APAC Support

+65 6031 0659

11 Doan Van Bo, 23rd Floor

Ho Chi Minh City, 700000

Vietnam

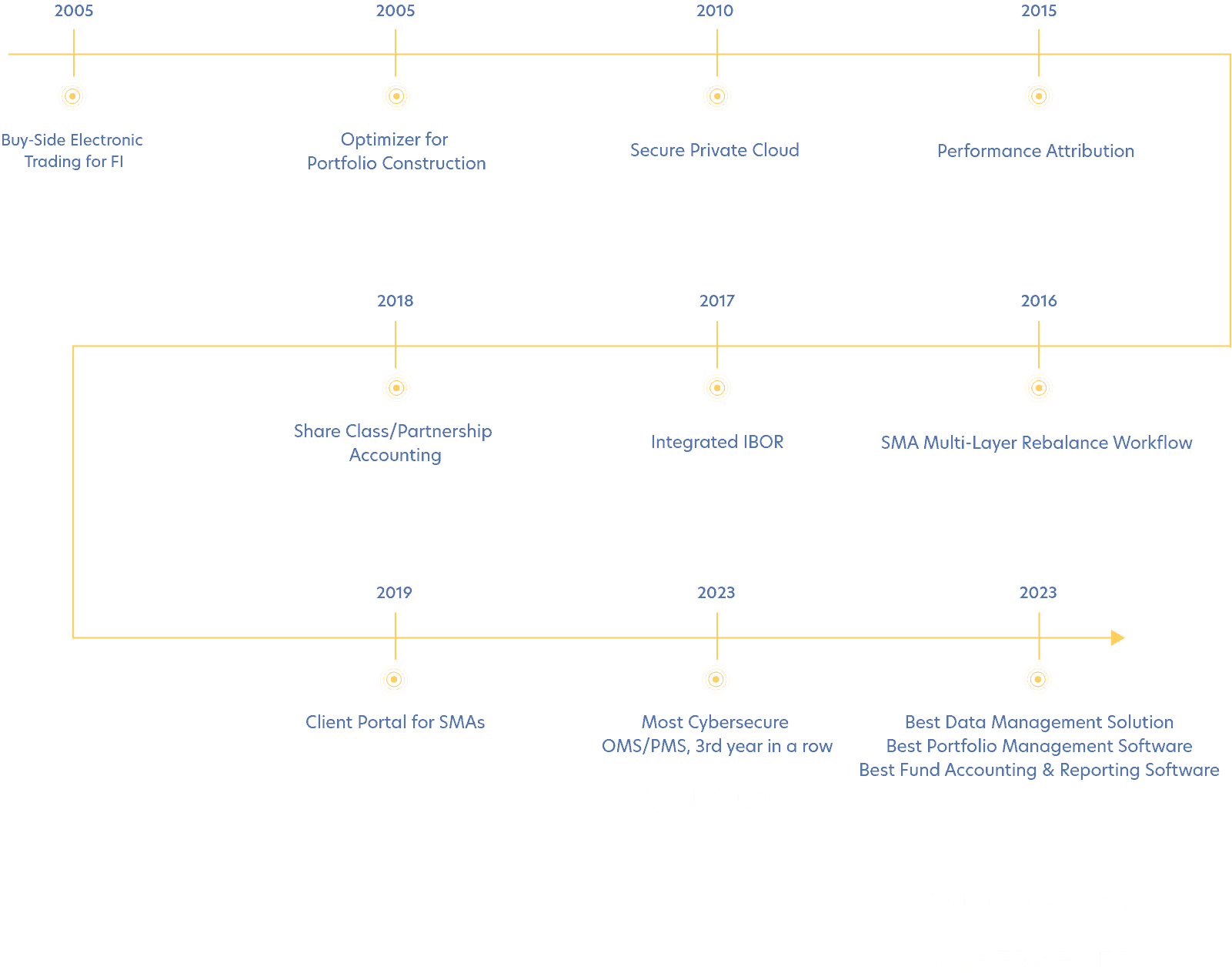

Athena was founded in response to a common problem in the Financial Industry: the inflexibility of many OMS/PMS solutions. Our mission is to empower our clients, offering a flexible and responsive system tailored to your specific needs.

Luis Otero, CTO of Athena & United Fintech

Athena eliminates the hassle of multiple platforms. Experience the convenience of unified, comprehensive management in one place.

Scott Sykowski, Managing Director & Head of Research at Athena

Our clients are the central focus at Athena. We cherish providing white-glove experiences and develop solutions that extend beyond mere tech support, integrating Athena as a core addition to your firm.

Stefano Guarnieri, Managing Director & Head of Product at Athena

Shape the digital future for financial institutions

together with United Fintech and our partner companies.